Big buyers don’t just buy products. They buy risk transfers. The price on your quote is one number, the perceived risk behind it is ten. The secret to winning enterprise procurement isn’t louder claims – its measurable reliability, transparent proof, and frictionless decision-making that reduce a committee’s risk perception.

What “Trust” means inside procurement

In large organisations, “trust” forms at two levels :

- Institutional trust (can your company deliver?) : financial resilience, certifications, compliance, governance, ESG hygiene.

- Operational trust (can your operations deliver?) : on-time performance, spec consistency, response speed, claims handling, and transparency during exceptions.

Typical enterprise buying committees involve 6–10 stakeholders across : Operations, Quality/Lab, Procurement, Finance, EHS/Compliance, and the Economic Buyer (P&L). Each optimises a different “risk,” so your offer must reassure all of them.

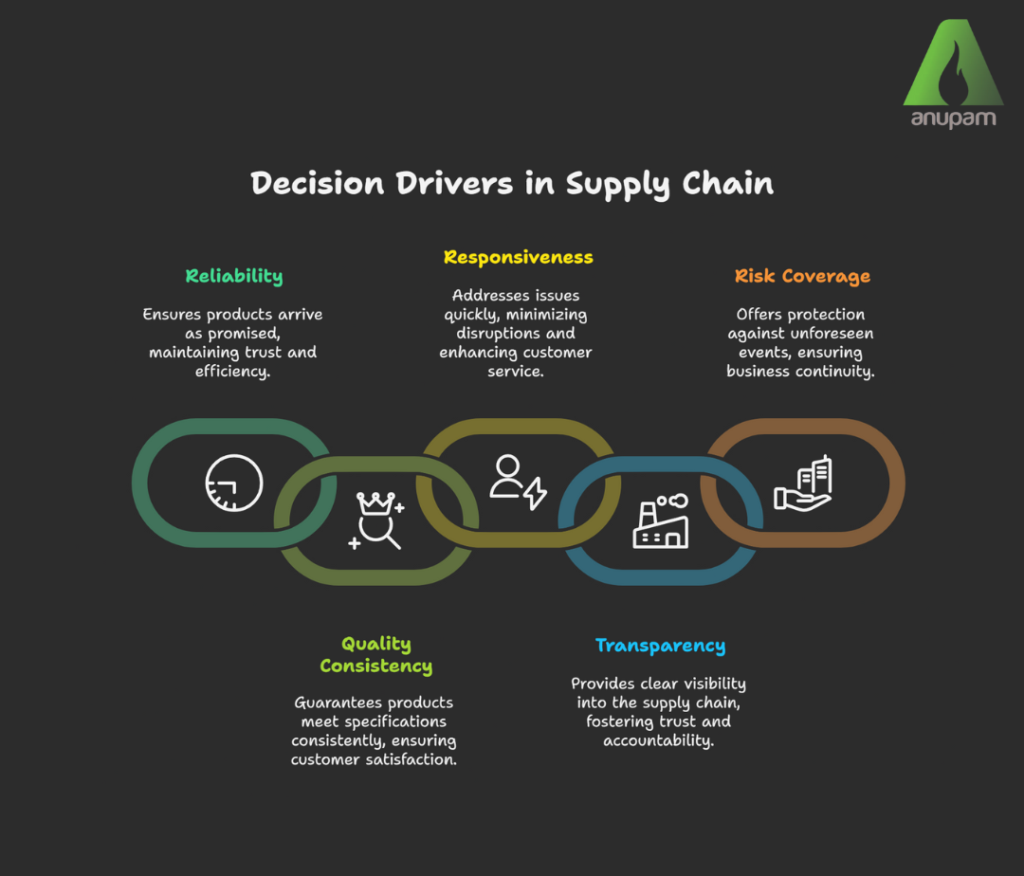

The five decision drivers (and how they’re measured)

Why committees are risk-averse (and how to work with it)

Procurement is shaped by cognitive biases :

- Loss aversion : a bad switch hurts more than a missed saving.

Counter : pilot lots, dual-run periods, performance credits. - Status-quo bias: existing vendors “feel safer.”

Counter : show comparative variance reduction, not just price. - Ambiguity aversion : unclear specs = stalled decisions.

Counter : lock contract basis (ADB/DB), test method, and penalty bands early. - Social proof : peers > pitches.

Counter : anonymised case metrics (“OTIF from 91% → 97% in 90 days”). - Confirmation bias : they look for validation of a risk they already fear.

Counter : pre-empt with data (e.g., moisture/ash caps, CRI/CSR ranges, TI/AI for pellets).

The “Trust Scorecard” procurement actually uses

Convert “we’re reliable” into a scored model a buyer can defend internally.

Trust Score =

35% Reliability (OTIF, lead-time variance) +

25% Quality Consistency (spec conformance, lab variance) +

15% Responsiveness (FRT, Claim TAT) +

15% Compliance/ESG (certs, audits, traceability) +

10% Financial Resilience (credit cover, working-capital adequacy)

Pass threshold (suggested): 80/100 for onboarding; 85+ for strategic supplier.

Example weights & thresholds (illustrative) :

- Reliability (35 pts) : OTIF 95–97% = 28–30 pts; schedule variance ≤ ±10% = 5 pts.

- Quality (25 pts) : spec conformance ≥ 98.5% = 20 pts; lab variance ≤ contract tolerance = 5 pts.

- Responsiveness (15 pts) : FRT < 4 hrs = 8 pts; Claim TAT ≤ 5 biz days = 7 pts.

- Compliance/ESG (15 pts) : ISO/CoC + audit pass = 12 pts; full traceability = 3 pts.

- Financial (10 pts) : credit lines + insurance = 10 pts.

Numbers that move the room (with simple math)

A. Cost of a late delivery (example)

- The plant burns 2,000 t/day → 83.3 t/hr.

- 8-hour delay = ~667 t not available.

- If each tonne’s contribution margin = ₹1,000, potential opportunity loss ≈ ₹6.67 lakh for that window.

- OTIF 95% → 98% can prevent 3 late events per 100 shipments; at 5 shipments/week, that’s ~7–8 events avoided/yr (material savings + avoided downtime).

B. Working capital freed by lead-time improvement

- Average shipment value ₹2 crore; average cycle 21 days → 14 days with better routing.

- Cash turns improve; 1 week freed across 12 cycles ≈ ₹24 crore-days less tied up annually (lower interest, higher agility).

C. Quality variance = hidden cost

- If GCV (ARB) drifts –80 kcal/kg on a 50,000 t lot, energy shortfall is material.

- If price pegs heat value, moisture controls + blending that keep ARB within ±50 kcal/kg protect real cost/ton of useful energy.

(These are illustrative calculations buyers recognise, plug your own numbers.)

Procurement’s “proof stack”: what wins RFP rooms

- Performance book : Last 12 months OTIF, conformance, Claim TAT; show trend lines improving.

- Spec hygiene : Contract basis (ADB/DB), penalty/credit bands, accepted test methods, and third-party lab protocols.

- Route transparency : Pre-agreed ports/berths, rake plans, alternates, and exception playbooks (monsoon, swells, congestion).

- Risk cover: Performance bonds or credit notes tied to clear triggers (e.g., moisture > X%, CSR/CRI outside tolerance).

- ESG & compliance: Safety stats, audits, traceability (lot → lab → invoice), CSR overview.

The three moments that decide trust

Moment 1 : First 10 minutes of the first call

- Buyers judge clarity. Lead with numbers, not adjectives: “Last 12 months: OTIF 96.8%, spec conformance 98.9%, Claim TAT 3.7 days.”

Moment 2 : The first exception

- Weather hit a laycan? Show live visibility, a new ETA, and a credit note (if applicable) before they ask. Exceptions handled well build more trust than smooth weeks.

Moment 3 : First 90 days live

- Set a launch scorecard:

- OTIF ≥ 95%

- Conformance ≥ 98.5%

- Claim TAT ≤ 5 days

- FRT < 4 hours

Review monthly. Publish wins & misses. Fix openly.

Offer design that reduces perceived risk (without slashing price)

- Anchor on reliability, not discount : Quote a “delivered-performance guarantee” (e.g., OTIF floor, moisture caps).

- Bundle onboarding : Free pilot lot QA, free spec-conversion workshop (ADB↔ARB), and a named single-thread contact.

- Tiered credits : Small credits for minor misses (e.g., moisture > band), larger for severe misses (e.g., non-delivery). Buyers see skin in the game.

- Dual-port/dual-origin plan : Present the redundancy on slide 1.

- KPI-linked rebates : Pay for performance improvements you can prove (e.g., lower variance → lower CoPQ).

The internal narrative the buyer needs (give it to them)

Large buyers must justify a new vendor upstream. Hand them a 1-pager :

- Baseline vs. Proposed (OTIF, conformance, Claim TAT)

- Risk Controls (penalties/credits, bonds, alternates)

- 30-60-90 Plan (milestones, reviews)

- Financial Impact (working-capital days freed, variance savings)

- ESG & Compliance (audits, traceability, CSR snapshot)

You’re not just selling to Procurement – you’re arming Procurement to sell you internally.

Quick templates you can reuse

A. 30-60-90 Live Plan (sample)

- Day 0–30: Pilot lots, dual-run; publish baseline KPIs.

- Day 31–60: Move to 50–70% allocation; enable live milestone tracking; first monthly review.

- Day 61–90: Steady-state volumes; sign off on penalty/credit audit; quarterly risk rehearsal (what if rake/berth closure?).

B. Trust Summary Card (1 slide)

- OTIF 96.8% | Conformance 98.9% | Claim TAT 3.7 days | FRT 2.9 hrs

- Dual origin + dual port • Weather clauses • Index bands • FX collars

- ESG & audits ✔ | Traceability ✔ | Performance credits ✔

C. Risk-to-Control Matrix (fill-in)

- Risk: Monsoon moisture → Control: covered yards + blending plan + moisture penalty band

- Risk: Port congestion → Control: dual berth + flexible laycan + despatch credits

- Risk: Grade slippage → Control: third-party sampling + referee lab protocol

In practice: How to move a skeptical buyer from “maybe” to “yes”

- Open with your proof metrics (not your brochure).

- Translate those metrics into the buyer’s money (idle hours avoided, cash freed, variance reduced).

- Show your controls (what happens when things go wrong).

- Make the first exception painless (pre-agreed credits + fast, proactive comms).

Enterprise procurement is a risk-filter. Trust is built when you measure what matters, publish it, and price in accountability. Do that, and the psychology shifts in your favour – from “Why should we change?” to “Why didn’t we do this earlier?”