There’s more tables within the blog – Use that with Anupam’s Logo as the watermark, please.

Extreme – condition modelling isn’t fantasy.

It’s how supply-chain managers, policymakers, and industrial buyers stress-test reality.

Let’s push two very real raw materials into hypothetical blackouts and see what actually breaks with numbers, timelines, and cascading impact.

No panic headlines.

Just cold, hard consequences.

Scenario 1

What If India Stopped Coal Imports for 48 Hours?

The Baseline Reality

- India consumes ~1 billion tonnes of coal annually

- Domestic production: ~75–78%

- Imports: ~220–250 million tonnes per year

- Coal contributes to ~70% of India’s electricity generation

- Power sector alone consumes ~80% of total coal

That means ~600–650 million tonnes of coal annually goes straight into power plants.

Hour 0 -12 : Nothing Seems Wrong

- Power plants typically maintain 10 – 14 days of coal stock

- Major plants near ports ( Gujarat, Maharashtra, Tamil Nadu ) rely heavily on imported coal

- Day-ahead electricity markets continue normally

- Spot power prices remain stable

No immediate outages

No media noise

This is the calm before the stress.

Hour 12 – 24 : Grid Starts Feeling the Pinch

- Coastal power plants burn higher GCV imported coal (5,500 – 6,000 kcal/kg)

- Domestic coal ( 3,500–4,000 kcal/kg ) is not a plug-and-play replacement

- Boilers calibrated for imported coal lose 5 – 8% efficiency when switched abruptly

- Rail logistics cannot reroute domestic coal within 24 hours

Early Effects :

- Frequency deviations on the grid

- Increased load on hydropower and gas plants

- Spot electricity prices spike by 15 – 20% in deficit regions

Hour 24 – 48 : The Dominoes Fall

Now the real cost appears.

Power Sector Impact

- Plants with <7 days stock begin load reduction

- 5 – 8 GW capacity faces partial shutdown risk

- Urban industrial feeders face controlled load shedding

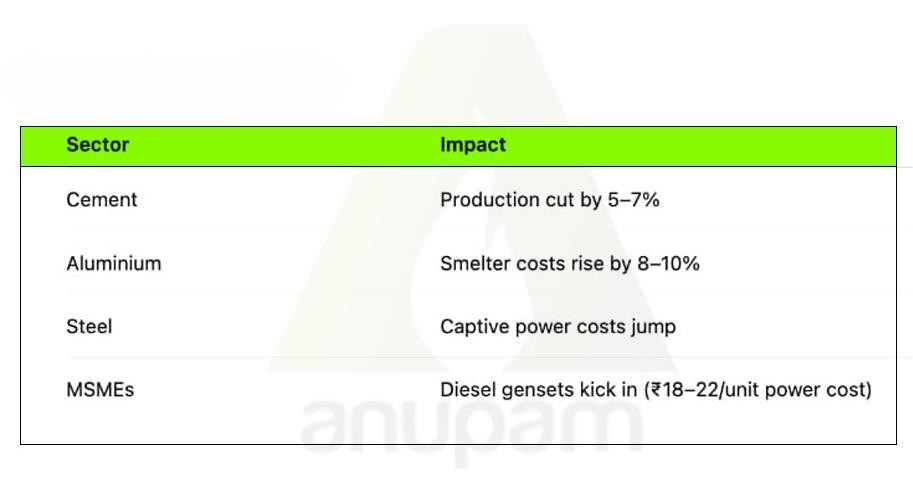

Industrial Impact

Financial Impact

- Additional power procurement cost : ₹1,200 – 1,500 crore/day

- Increased diesel consumption : ~8–10 million litres/day

- CO₂ emissions rise due to diesel fallback

The Big Insight

48 hours doesn’t shut India down.

It exposes how thin the buffer actually is.

Coal imports are not “backup” – they are load balancers.

Scenario 2

What If Scrap Vanished for a Week?

Now this one hurts faster.

The Scrap Reality

- India consumes ~30–35 million tonnes of steel scrap annually

- EAF & IF route contributes ~45–50% of India’s steel production

- Scrap-based steel uses :

- 60–70% less energy

- ~75% less CO₂ than ore – based steel

Scrap is not optional anymore – it’s structural.

Day 1 – 2 : Panic Without Headlines

- EAFs operate on 3 – 5 days of scrap inventory

- Prices react immediately

Market Reaction

- Scrap prices jump ₹3,000 – 5,000/tonne within 48 hours

- Importers rush to book cargoes

- Domestic scrap dealers freeze sales expecting higher prices

Day 3 – 5 : Production Starts Breaking

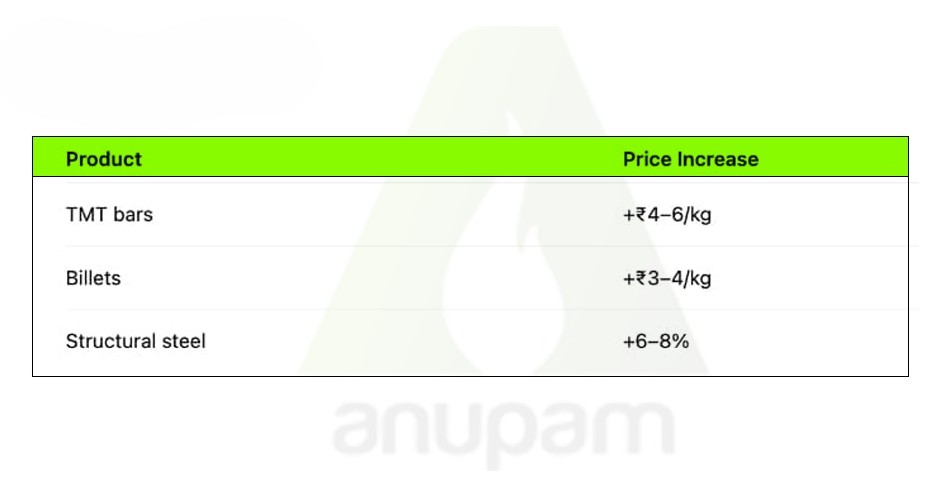

Steel Impact

- 25 – 30% of induction furnaces shut temporarily

- Billet and TMT supply tightens

- Re-rollers operate at 60 – 65% capacity

Price Impact

Day 6 – 7 : The Construction Shock

- Infrastructure projects slow

- Private real estate pauses procurement

- Government contractors invoke force majeure clauses

Ripple Effect

- Cement demand drops temporarily

- Labour deployment disrupted

- Working capital cycles stretch by 10 – 14 days

Environmental Irony

- Some plants switch to sponge iron

- CO₂ emissions rise 30 – 40% per tonne of steel

The Big Insight

Scrap isn’t just a raw material.

It’s India’s decarbonisation shortcut.

A one – week disruption can :

- Spike steel inflation

- Reverse emission gains

- Stall infrastructure momentum

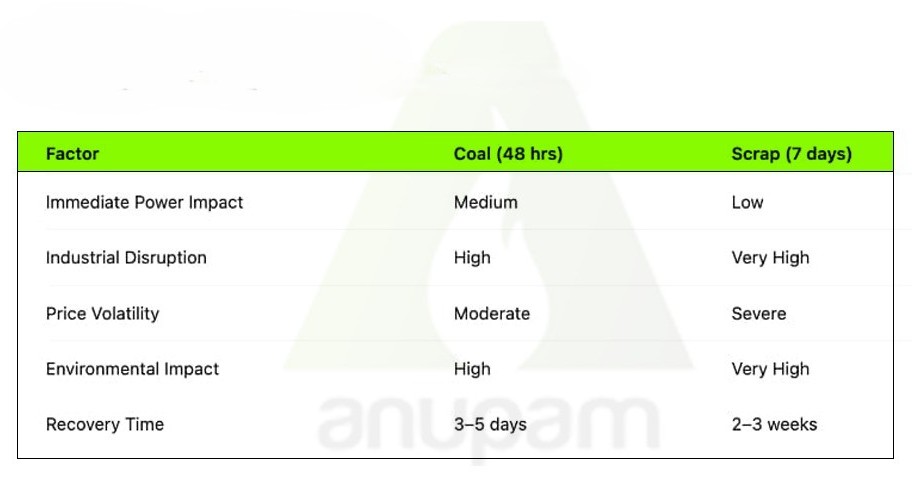

Coal vs Scrap : Who’s More Dangerous to Lose?

Coal shocks the grid.

Scrap shocks the economy.

Why does this matter?

Extreme – condition thinking reveals truths that normal planning hides :

- Inventory buffers are thinner than reported

- Substitution is rarely instant

- Price shock travels faster than physical disruption

- Sustainability collapses first under stress

India doesn’t collapse when raw materials disappear briefly.

It reveals its pressure points.

And the smartest businesses don’t ask : Will this happen? They ask : What breaks first if it does?