Ever wondered what really happens between “Order placed” and “Boiler fired”? A coal shipment’s journey is a relay – mining, quality control, evacuation, ports, ocean, last-mile and every baton pass adds risk, time, and cost. Understanding that chain is the edge smart buyers use to lock quality and trim delivered cost.

At the pit : mining, sizing, grading

- The cycle : drilling & blasting → excavation → crushing/sizing → (beneficiation if applicable) → dispatch yard.

- Quality control starts here. India’s coal is sold by declared grade (GCV bands). Today, independent Third-Party Sampling (TPS) is standard at loading points to curb grade slippage; grade conformity improved to ~76% in FY24 and is tracking even higher in FY25, thanks to tighter SOPs and first-mile controls.

- Scale matters. India’s coal output hit ~1,048 million tonnes in FY25, a new high that’s eased panic buying and smoothed rakes to plants.

First-mile evacuation : rapid loading & rakes

- Rapid loading silos now dominate large mines—reducing contamination and dwell.

- What is a rake? Think 58–60 wagons per train. Payloads vary by wagon type:

- BOXNHL rakes: ~4,100 t per rake (58 wagons × ~71 t/wagon).

- BOBR/BOBRN rakes (bottom-discharge): ~3,000–3,200 t per rake.

- Speed reality check : Indian Railways’ average freight speed ~25 km/h – your best friend is pathing & priority, not wishful thinking.

At the port : capacity, queues, rain, and rates

- Major Indian ports handled ~855 MMT cargo in FY25, coal is one of the biggest slices. Paradip retained the top spot among major ports and crossed 150 MMT total cargo in FY25, with thermal coal/coastal coal a major driver.

- Specialized coal systems matter: Paradip’s mechanized CHP is designed for ~42 MTPA thermal coal (stackers, reclaimers, ship-loaders/unloaders), which reduces weather downtime and speeds turnarounds.

- Private ports like Dhamra have scaled hard; capacity is planned/expanded toward ~100 MTPA, improving berth availability for bulkers.

Monsoon watch : Rain raises surface moisture, lowers ARB GCV, and slows handling; the fix is covered yards, faster turnover, and smart blending.

The ocean leg : laycans, sizes, and risk

- Importers to India commonly charter Capesize (150–180k DWT) and Panamax/Kamsarmax (70–85k DWT) depending on draft and berth.

- Routing volatility (Red Sea diversions/Cape of Good Hope) can swing freight and laytime. India’s ports absorbed volume shocks well in FY24–25; Adani Ports alone handled ~420–450 MMT in FY24–FY25, hinting at slack for rerouting.

Ops tip: Build demurrage/despatch clauses for weather & route risk; lock laycan windows that match rail arrival cadence.

Back to shore : discharge → stockyard → last-mile

- Discharge rates depend on mechanization; faster unloaders reduce rain penalties.

- Last-mile is often rail again. Coastal plants optimize with coastal shipping + short rail/road legs.

- Why stock days matter: CEA’s dashboards showed ~18 days of coal at thermal plants (Aug 1, 2025)—healthy, but vulnerable if monsoon or rake allotment slips.

Quality translation: ADB vs ARB, and why buyers argue about rain

ADB vs ARB: Most contracts price on GCV (ARB) because that’s what your boiler sees after weathering/handling. Rain spikes total moisture → lowers ARB GCV and can trigger penalties unless blending or re-sizing is built in. (Use TPS SOPs to keep disputes short.)

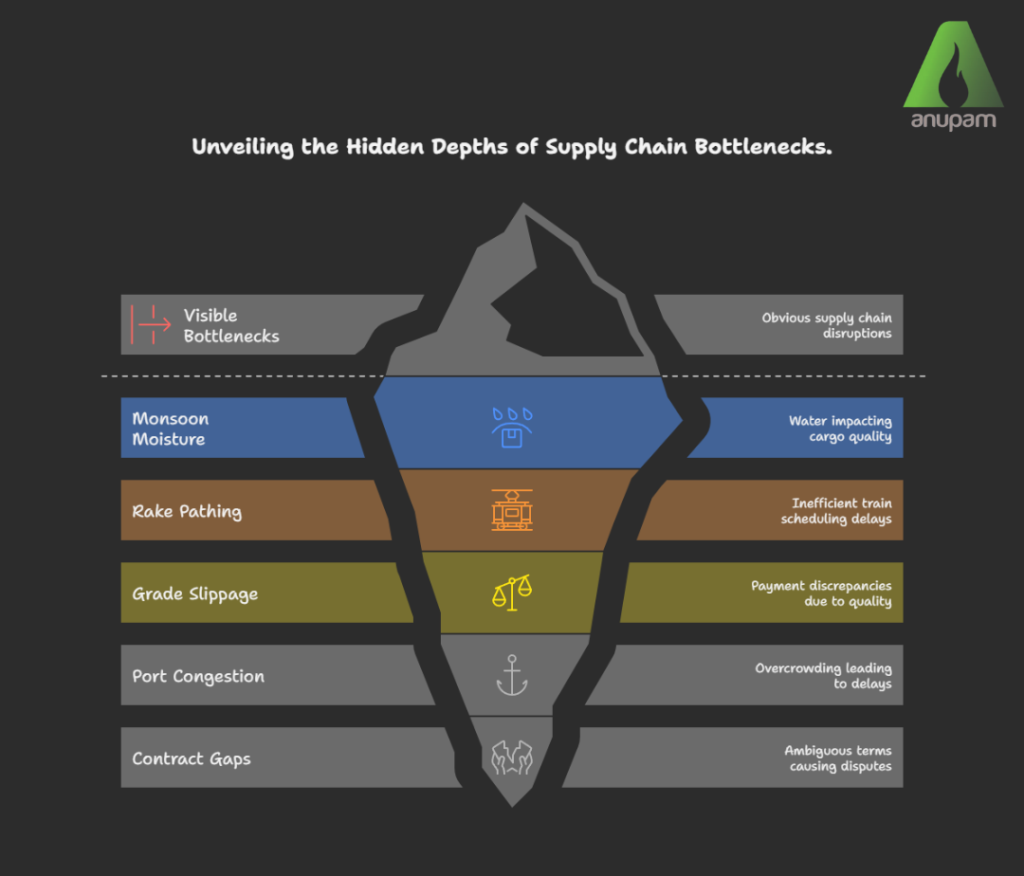

Bottlenecks (and fixes)

What great buyers track (a checklist you can steal)

- Supply KPIs: Grade conformity %, rake allotment vs plan, rake payload mix (BOXNHL vs BOBRN), port dwell.

- Market signals: Port coal shares at major ports, private port capacity notices, coastal shipping trends/inland waterway options.

- Plant risk: Target days of stock by season (aim higher pre-monsoon).

Coal logistics is a chain of small wins : tighter sampling, better rake planning, smarter port choices, and moisture-aware specs. When each link is managed, delivered cost falls and boiler performance rises.