In the evolving landscape of steel production, 2025 has emerged as a pivotal year. With nations pushing for sustainability and industries optimizing for cost, the age-old question resurfaces: Should we rely on scrap or stick to iron ore for our steel? Let’s break down the facts, data, and realities to discover how India—and the world—are navigating this critical choice.

Global Steel Production : 2025 Snapshot

According to the World Steel Association (May 2025):

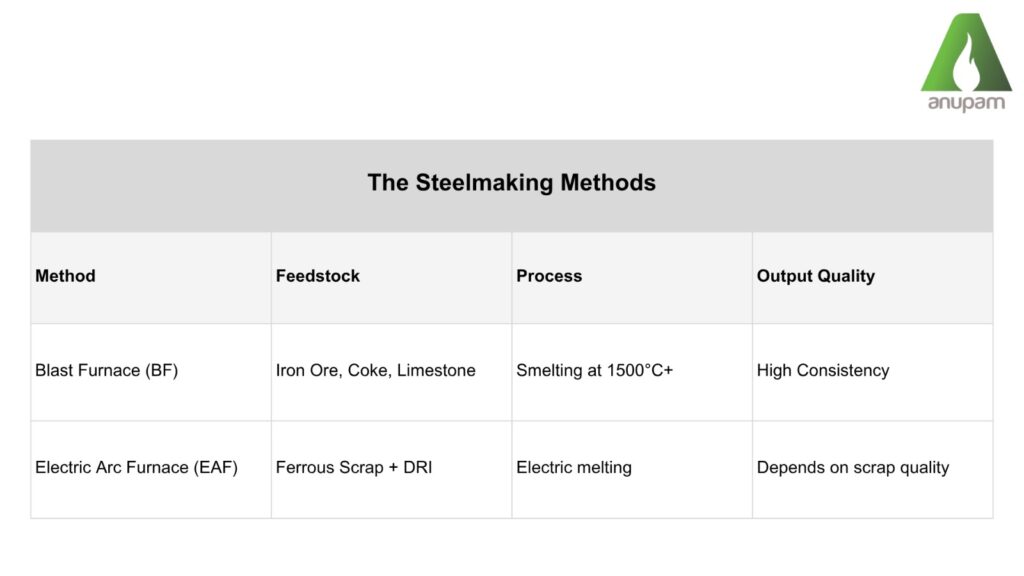

- 72% of global crude steel still comes from iron ore (BF-BOF route).

- 28% is made via EAFs using recycled scrap.

- India, while traditionally reliant on iron ore, has increased EAF usage by 17% YoY due to scrap availability and sustainability goals.

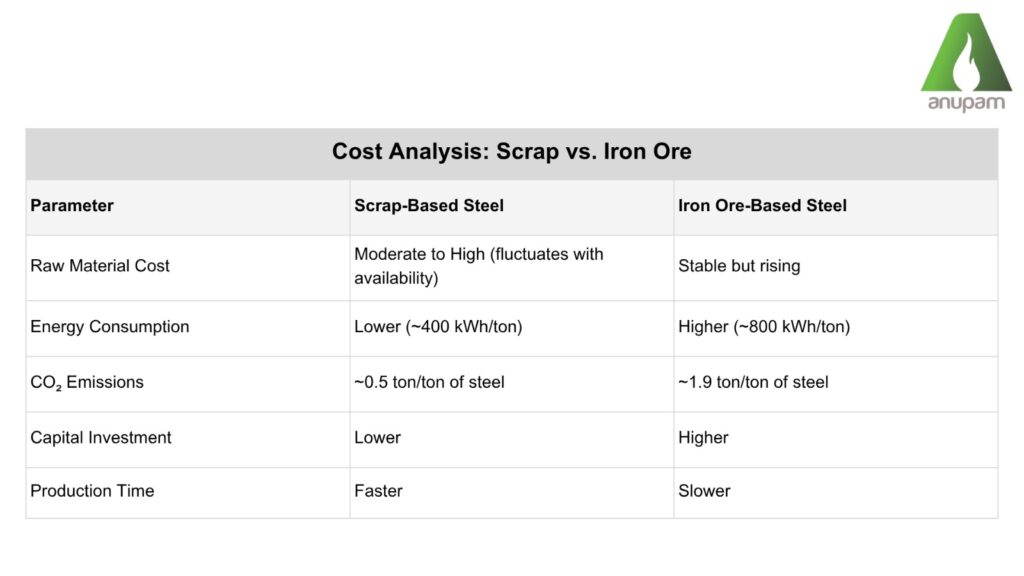

2025 Insight : Scrap prices have increased due to global demand, but the reduced energy cost and quicker turnaround make it a smart choice for many secondary steel producers

Quality & Consistency : What’s the Industry Saying?

Q: Is scrap-based steel less consistent?

A: It depends. If scrap is well-segregated and sourced from reliable vendors (like Anupam Fuels’ international scrap offerings), the difference is negligible.

Fact: 2025 data from BIS (Bureau of Indian Standards) shows 80% of EAF-produced TMT bars passed the same strength and chemical composition benchmarks as BF-produced bars.

Q: Which is better for automotive or precision applications?

A: Pig iron and ore-based steel still dominate high-end applications like automotive parts, where micro-alloying and exact tolerances are required.

Fun Fact Break

- Did you know? Over 600 million tons of steel are recycled globally every year—saving nearly 945 million tons of CO₂.

- India alone has the potential to double its steel scrap utilization by 2030.

Sustainability & The ESG Angle

Governments and corporations are under immense pressure to meet ESG (Environmental, Social & Governance) standards.

- Scrap steel production emits up to 70% less CO₂ than traditional methods.

- Water usage is also significantly lower, making scrap-based steel the environmentally preferred option.

The Indian government has introduced policies incentivizing scrap collection centers and EAF adoption under its Circular Economy Action Plan 2025.

Supply Chain Advantage : Why Scrap is Winning in 2025

Global conflicts, like the ongoing tensions in the Indo-Pacific, have impacted iron ore supply chains. In contrast, scrap can be sourced domestically and globally with greater flexibility.

2025 Logistics Insight: Secondary steel producers with diversified scrap sources had 22% lower downtime than their iron-ore-reliant counterparts.

Real – World Use Cases

Case 1 : TMT Bar Manufacturer in Raipur

Switched 70% of their feedstock from sponge iron to scrap.

- Reduced electricity bill by 21%

- Lowered per-ton cost by ₹1,200

- Increased production speed

Case 2 : Foundry in Gujarat

Still prefers pig iron due to high precision castings and consistency.

- 100% rejection rate cut by 35%

- More predictable chemical composition

Q & A with Industry Experts

Q: Will scrap overtake iron ore in 2030?

A: Not entirely. A hybrid model will emerge,bulk steel via ore, specialty and quick production via scrap.

Q: Should small manufacturers shift to scrap?

A: If you’re producing rebars, angles, or general structural steel,scrap is viable. Pig iron or sponge iron is still essential for foundries or critical applications.

The Anupam Fuels Advantage

Whether you’re buying:

- Pig Iron for consistency

- Ferrous Scrap for savings

- Billets, Pellets, or Coke for flexibility

Anupam Fuels brings :

- Reliable sourcing

- Pan-India logistics

- Industry-trusted quality

Make smart sourcing decisions in 2025. Balance cost, consistency, and compliance with Anupam Fuels as your steel material partner.

Scrap or Ore—It’s Not Either/Or

The steel industry in 2025 is no longer a one-size-fits-all model. Smart businesses will balance the two—leveraging scrap for its cost and environmental benefits, and pig iron for its reliability and quality.

Looking to optimize your raw material strategy?

Reach out to Anupam Fuels—India’s trusted name in fuels, scrap, iron, and more.